Corporate Bonds: Wall Street’s IOUs With Teeth

Corporate bonds are companies’ IOUs — offering income, diversification, and risk tied to the issuer’s survival. From blue-chip safety to junk bond landmines, here’s what they are, how they work, and why they matter for investors.

Treasury Bills: The Market’s Risk-Free Parking Spot

Treasury bills are the market’s “risk-free” parking spot — short-term IOUs from Uncle Sam. Simple, safe, and liquid, but not always the best bet. Here’s why T-Bills matter for portfolios and global finance.

Bonds: The IOUs That Rule the Market

Bonds are the market’s referee — steady income, diversification, and the signal for risk. They’re not sexy, but they set the rules. Ignore them at your peril.

Practical Steps: Understanding Mutual Funds

Mutual funds aren’t black boxes — they’re tools. The key is knowing when they fit and when to skip them. From fees to benchmarks to tax efficiency, here’s the practical checklist that keeps you out of the trap.

Mutual Funds: Why They Keep Failing Investors

Mutual funds promise diversification and simplicity, but the reality is far less friendly. High fees, weak performance, surprise taxes, and limited flexibility make them a costly trap for many investors. Here’s why they keep failing—and smarter ways to invest.

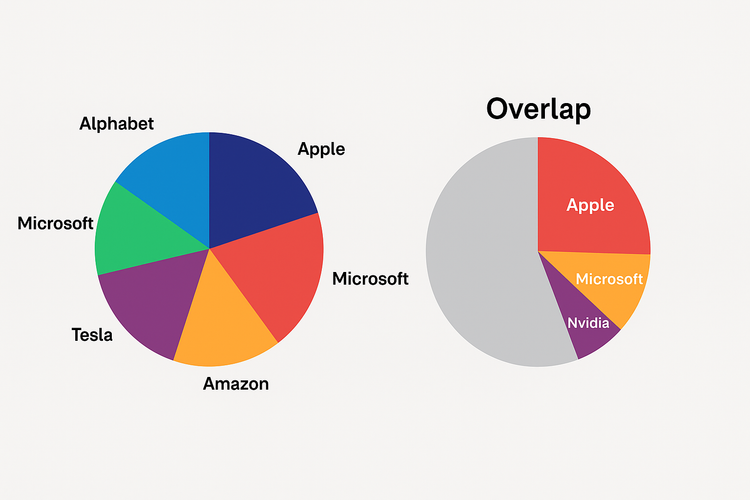

How ETFs Hide Concentration Risk — And Why It Matters

ETFs promise easy diversification—but overlapping holdings can leave you heavily exposed to the same few mega-caps. Here’s how concentration risk sneaks in, and what you can do to fix it.

The Buffett Myth: Why His Playbook Won’t Make You Rich

Buffett's public tips won't replicate his success. His real advantages—massive float, exclusive access, institutional scale—aren't available to retail investors.

Mutual Funds Today: Diversification or Dead Weight?

Mutual funds promise diversification and professional management, but most lag the market. Here’s where they still fit, where they fail, and why ETFs may have the edge.

How Do Stock Dividends Work? Your Paycheck for Owning Stocks

Dividends aren’t free money. They’re the market’s paycheck for owning real businesses. Here’s how they work, why they matter, and how to use them to actually build wealth.