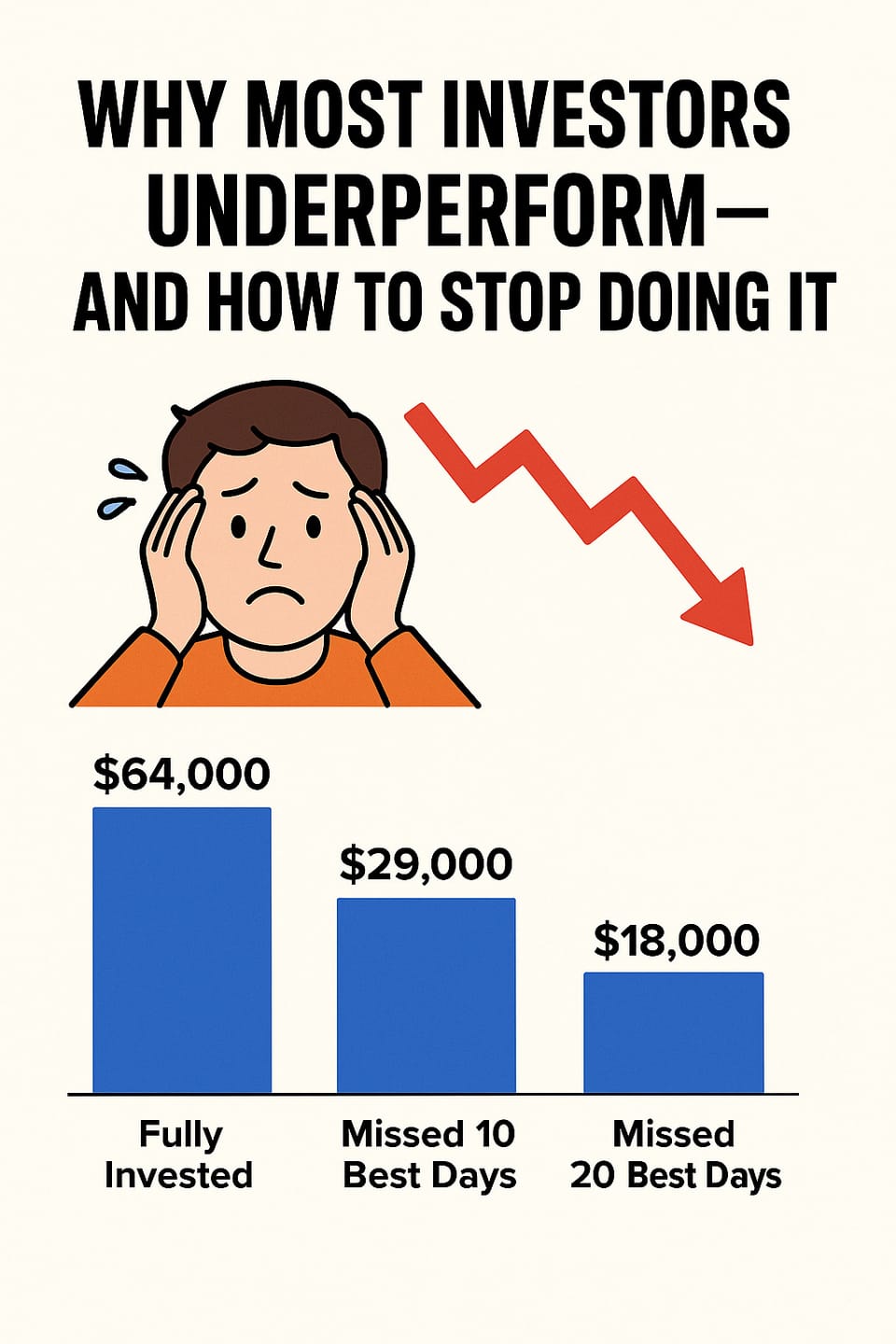

Why Most Investors Underperform — and How to Stop Doing It

Missing just a few good days can cost you half your portfolio. Here’s how to stop the bleeding.

If you invested $10,000 in 2003 and never touched it… you'd have $64,000 today.

But if you panic‑sold just once and missed the market’s 10 best days?

You're probably sitting closer to $29,000.

That’s how investors sabotage themselves—not with bad picks, but with bad timing driven by fear.

🤯 It’s Not a Timing Problem — It’s a Strategy Problem

Most people think they’re long-term investors…

Until a 20% drop hits and they start doomscrolling CNBC.

Here’s what actually happens:

Investor A

-Held through the 2022 dip

-Recovered fully by 2023

Investor B

-Sold mid-2022 “to be safe”

-Bought back higher, missed rebound

Investor B thought they were playing it smart.

Instead, they locked in losses and missed the recovery.

This isn’t rare. It’s how the average investor underperforms — again and again.

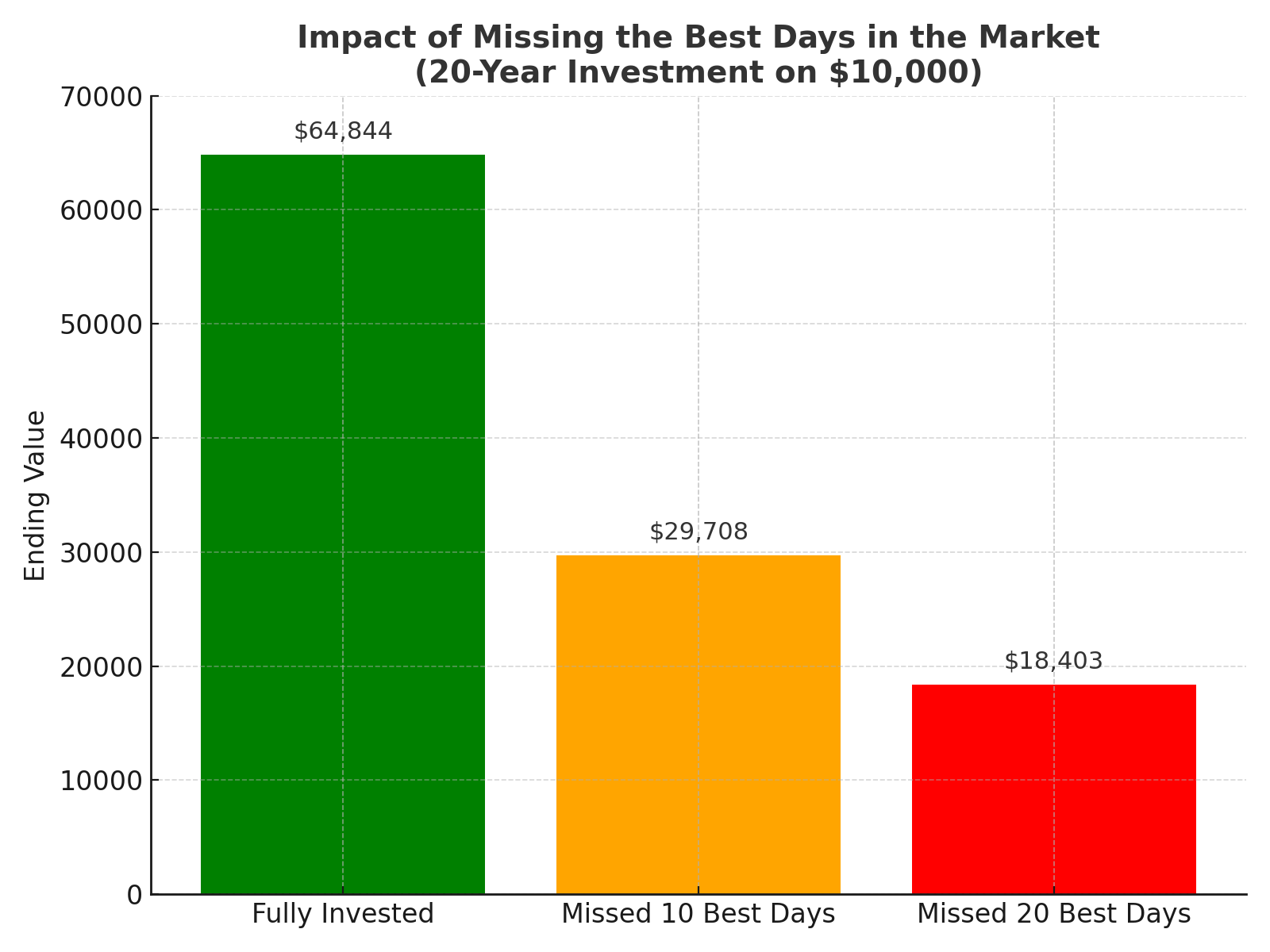

📉 The Numbers Don’t Lie

Research from J.P. Morgan shows:

Scenario Annual Return Ending Value on $10,000 (20 Years)

Fully Invested 10.6% $64,844

Missed 10 Best Days 6.4% $29,708

Missed 20 Best Days 3.7% $18,403

Source: J.P. Morgan Private Bank – The Power of Intent

Additional reference: Chase – 4 Reasons to Stay Invested

Also cited by: J.P. Morgan Europe – Strengthen Your Portfolio

😬 Why Does This Keep Happening?

Because most portfolios have no real strategy.

They’re just a random pile of stocks and ETFs someone liked.

No system. No structure. No conviction.

So when the market gets ugly… they bail.

💡 The Fix: Clarity Over Chaos

When you follow a real investing strategy — like:

- “Buy quality companies and hold”

- “Dollar-cost average into index funds”

- “Focus on high‑cash‑flow dividend payers”

…you stop second-guessing every market headline.

You know why you hold what you hold — and that’s what keeps you grounded when others panic.

🧠 Final Thought

You don’t need to be Warren Buffett.

You just need a plan you won’t abandon when everyone else is freaking out.

Long-term success doesn’t come from perfect timing.

It comes from knowing why you’re invested — and having the conviction to stay the course.

This post is part of a series on building that kind of clarity. More soon.

Member discussion